Crypto and Web3's 12 Biggest Narratives in 2026

From prediction markets and ZK privacy to RWAs, DePAI, and agentic finance—discover the top crypto narratives driving Web3 in 2026 and where smart money is flowing.

Key Takeaways

- Crypto in 2026: real utility and infrastructure, not speculation.

- Stablecoins will power cross-border payments.

- RWA tokenization will revolutionize illiquid markets.

- AI agents will increasingly trade and manage portfolios autonomously.

- Privacy and ZK proofs will become a critical competitive moat.

- ETFs and corporate treasuries will deepen Wall Street's crypto integration.

- Fairer launchpads will replace opportunistic airdrops with milestone-based funding.

- 'Spec is law' security frameworks will help prevent exploits before they happen.

Introduction

Crypto bull runs typically follow a familiar pattern: explosive hype, quick speculation, then a sobering bear market that separates the real builders from the noise. After a brutal start to 2026 (with Bitcoin crashing below $60,000), we’ve seen the Fear and Greed index plummet to as low as 5, a new record.

With Altseason delivering little more than air, the crypto industry has risen from the dead with a big hangover. It’s sobered up again, and ready to enter a new phase focused more on substance over speculation, at least for 2026.

Even though the meme coin sector is still worth $30 billion, smart investors are shifting toward projects with real-world utility, sustainable yields, and bridges to traditional finance. Instead of piling in after “number go up” tokens, the smart money is flowing into infrastructure: payment rails, credit markets, privacy protocols, and practical tools that actually work.

This next frontier for crypto creates space for genuinely exciting narratives to emerge. Let’s explore the narratives driving cryptocurrency and Web3 in 2026.

The Biggest Crypto Narratives of 2026

Download the complete PDF guide covering all 12 crypto narratives—from prediction markets and ZK privacy to RWAs, DePAI, agentic finance, and security frameworks.

1. Prediction Markets & GambleFi

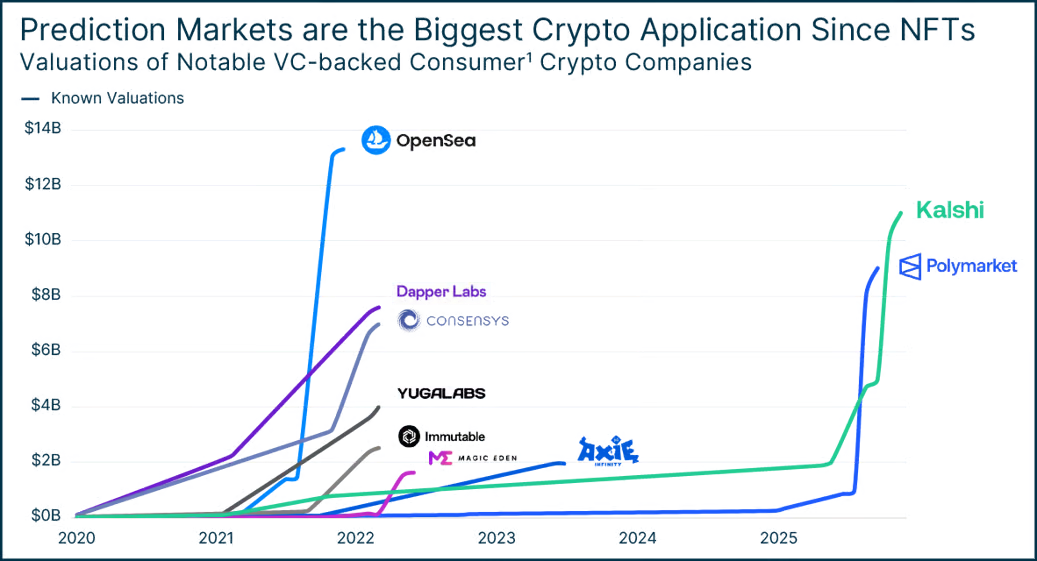

After Polymarket’s stunning success predicting the 2024 US elections, prediction markets—sometimes called “GambleFi”—have become one of crypto’s hottest narratives.

Source: SVB

Rather than reading dozens of articles to gauge whether an event will happen, you can check platforms like Polymarket or Kalshi (who is now on Solana) to see what people are willing to bet real money on. These markets now cover everything from weather patterns to corporate earnings and on-chain metrics. Prediction market volume hit $28 billion during the first ten months of 2025 alone.

Analysts predict a buyout exceeding $1 billion in this sector as institutional infrastructure consolidates. Regulated, high-liquidity prediction markets are becoming mainstream sources of sentiment and data, helping traders rotate capital more efficiently across markets.

2. Privacy & Zero-Knowledge (ZK) Technology

Privacy has finally moved from a niche feature to a critical competitive advantage. Zero-knowledge proofs are moving beyond scaling solutions to enable identity verification and confidential DeFi, allowing users to prove attributes without revealing full data.

Privacy coins saw a revival in 2025. Zcash rallied over 1,000%, its shielded pool supply tripled, and fully private transactions climbed to 20% of network volume. Zero-knowledge protocols like Railgun processed $1.6 billion in shielded transactions, while HoudiniSwap averaged $95 million monthly.

Industry analysis warns that privacy will be the most important competitive moat in 2026 because while bridging tokens between chains is easy, “bridging secrets is hard.” Institutional adoption is growing too—Paxos partnered with Aleo to launch a compliant private stablecoin, and U.S. sanctions on Tornado Cash were lifted.

For real-world applications like remittances or identity verification, privacy isn’t optional anymore—it’s essential.

3. Meme Launchpads 2.0 and the ICO Revival

Remember the ICO chaos of 2017? The scams, the rugpulls, the regulatory nightmares? In crypto, everything comes full circle if you wait long enough.

Launchpad platforms are making a comeback—but this time with stronger protections.

These “Meme Launchpads 2.0” build on no-code platforms like Pump.fun but add crucial safety features: anti-sniper protections, bonding curves that lock liquidity until projects hit milestones, and reputation systems rewarding genuine community members. Community ICOs raised over $341 million in just the 62 days before the end of 2025, with platforms like Legion, MetaDao, and Coinlist leading the charge.

Instead of pump-and-dump schemes, these launchpads release funds only after projects meet specific milestones and demonstrate solid tokenomics. It’s a sign that community-driven fundraising with clear terms might finally replace opportunistic airdrops.

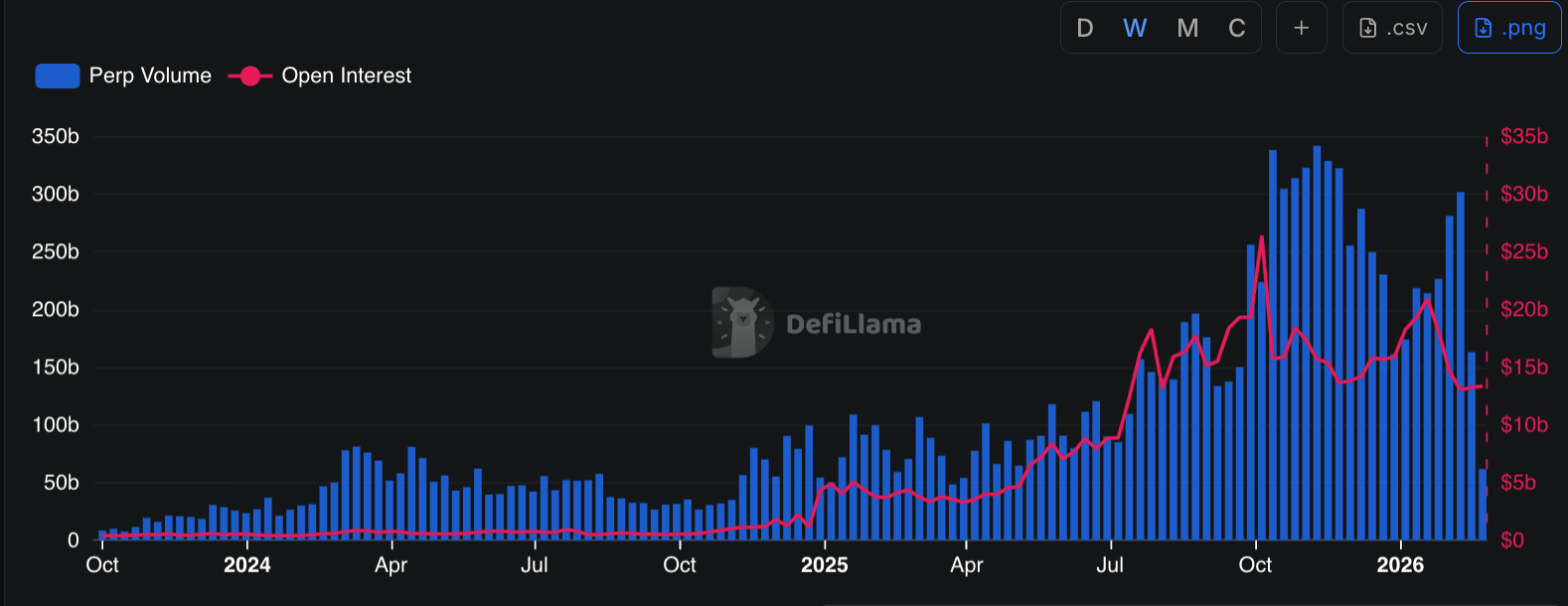

4. Perpetual DEXs & Derivatives

Decentralized perpetual exchanges (perp DEXs) have closed the gap with centralized platforms and now represent a force in crypto trading. Perp DEXs achieved $26.6 billion in 24-hour trading volume and $15.5 billion in open interest by Dec 2025.

Platforms like Aster and Hyperliquid offer sub-second execution and deep liquidity, letting traders use liquid staking tokens as collateral to trade tokenized stocks and commodities with leverage. Perpetual futures already account for roughly 78% of crypto derivatives volume. DEX trading volume reached 20% of spot volume and 10% of futures volume by year-end 2025.

The winners in this space will be platforms offering capital-efficient products, low slippage, and innovative risk management for both retail and institutional traders.

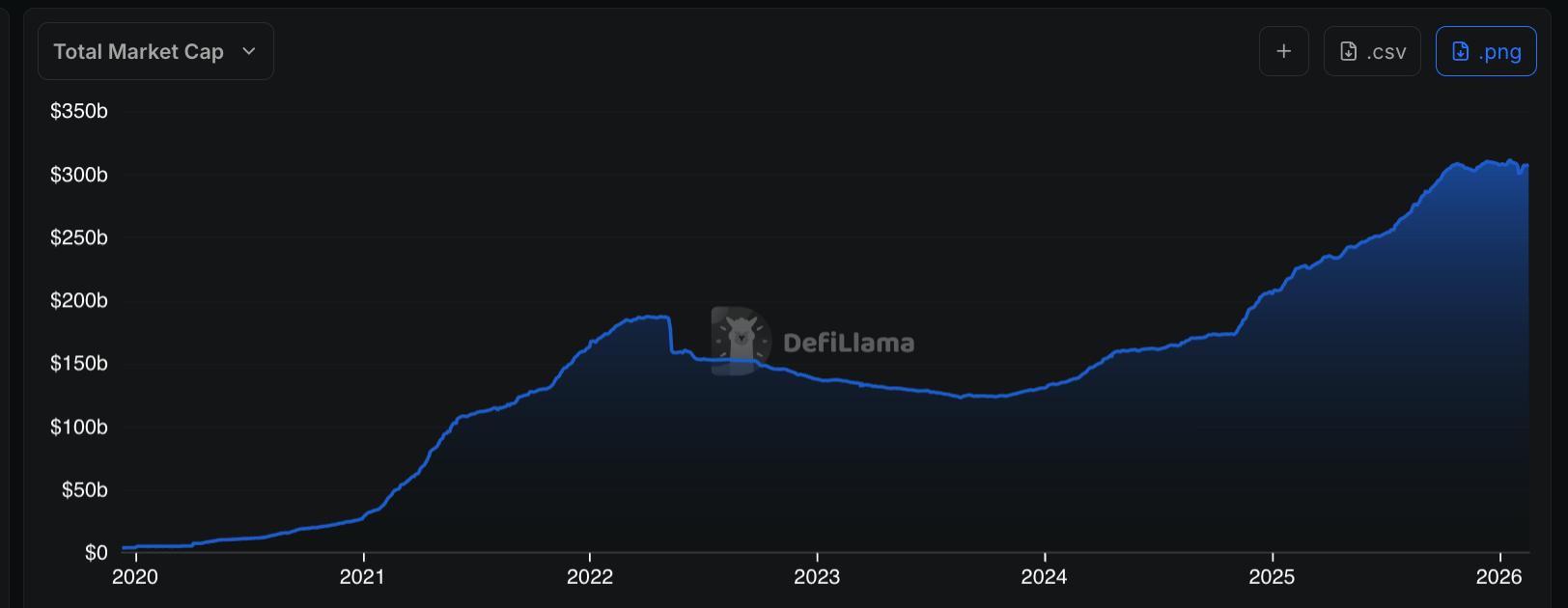

5. Stablecoins: Money of the Internet

Stablecoins are the invisible infrastructure powering many 2026 narratives, acting as payment rails for DeFi and cross-border transactions. The total stablecoin market cap grew from $205 billion to roughly $310 billion in 2025, with Tether holding over 60% market share.

DeFiLlama: Stablecoin growth from 2020 to 2026

Several stablecoin-specific blockchains—Stable, Plasma, Circle’s Arc, and Stripe & Paradigm’s Tempo—launched or entered testnet. European and Japanese bank consortia are preparing MiCA-compliant Euro and Yen stablecoin chains, while the U.S. GENIUS Act mandates 100% reserve backing and excludes payment stablecoins from securities laws.

Stablecoins are moving from crypto niches to practical business tools, reducing currency conversion costs and settlement delays. Analysts predict stablecoin capitalization could surpass $500 billion in 2026 and eventually exceed $2 trillion, with banks issuing consortium stablecoins pegged to G7 currencies.

6. ETFs & Digital Asset Treasuries Onboard Wall Street

Crypto exposure through traditional investment vehicles accelerated dramatically in 2025, as regulators in the United States become crypto-friendly. After the SEC approved generic listing standards for commodity-based trusts in Sep 2025, the first spot altcoin ETFs tracking Solana and XRP launched in October. Over 126 additional crypto ETF applications are pending, and some ETFs now incorporate staking to generate yield.

Digital Asset Treasury (DAT) companies are publicly traded firms who are holding Bitcoin or Ethereum as strategic assets. They exploded from four companies in 2020 to over 200 by late 2025.

MicroStrategy (rebranded as Strategy) holds roughly 672,500 BTC alone.

By mid-Dec 2025, 17.9% of all Bitcoin was held by public companies, ETFs, and sovereigns, with 164 public companies collectively holding $148 billion in digital assets.

TradFi firms are increasingly using crypto to diversify reserves. DATcos provide an alternative for investors seeking crypto exposure through equities.

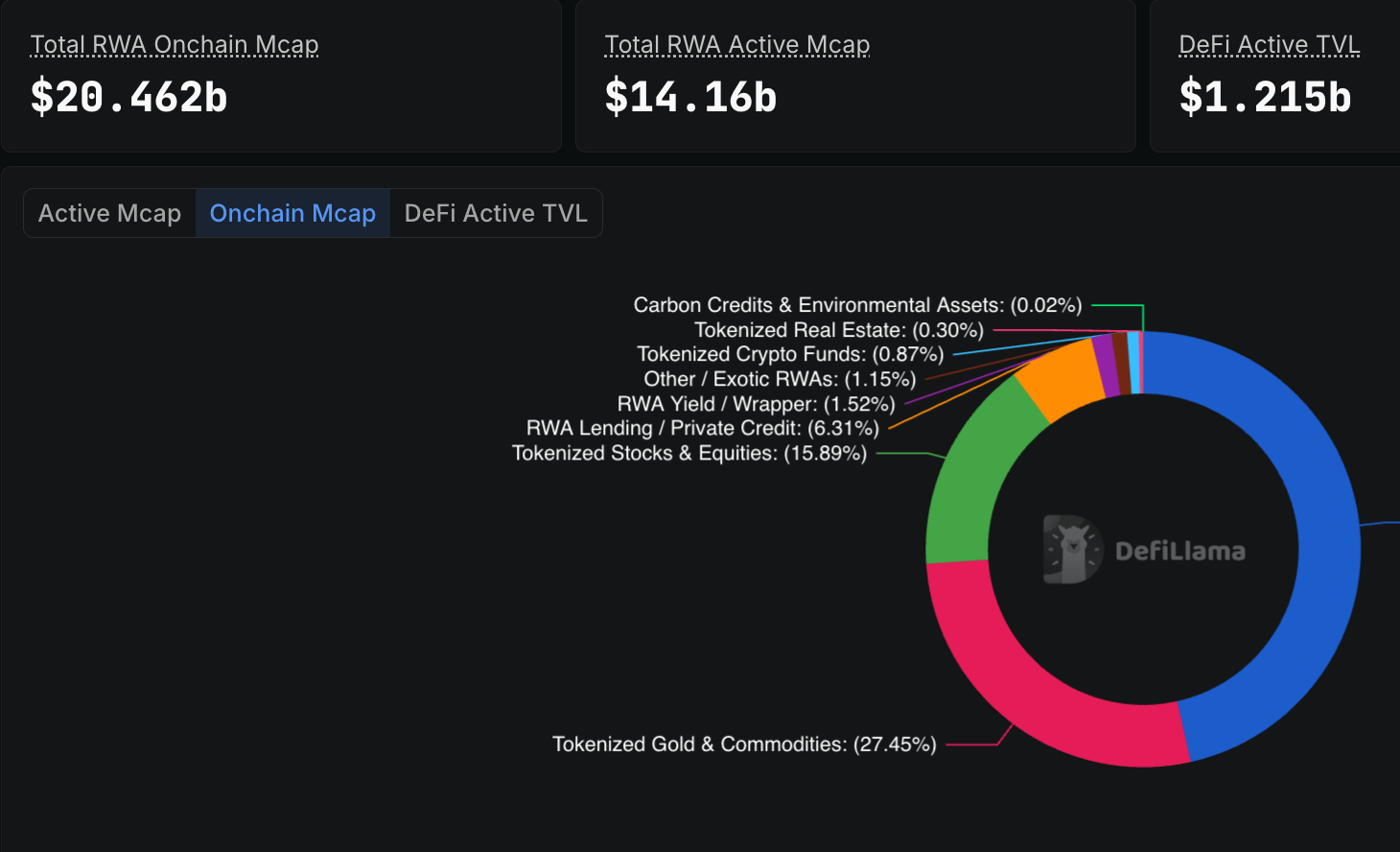

7. RWAs Continue to Tokenize the World

Real-world asset (RWA) tokenization is one of the fastest-growing sectors. On-chain tokenized RWAs tripled from $5.5 billion to $18.6 billion during 2025, with tokenized Treasuries maturing and attention shifting to private credit and tokenized real estate. BlackRock’s BUIDL fund leads the tokenized Treasury space with more than $1.7 billion in assets.

Source: DeFiLlama

Dec 2025 marked a historic milestone: the total value locked (TVL) in RWA protocols exceeded that of decentralized exchanges, reaching $19 billion. This “flippening” signals the end of crypto’s silo era.

Tokenization enables fractional ownership of normally very illiquid assets like real estate, art, and intellectual property, making them accessible to retail investors who can buy a piece of it as part of a group and sell it with ease.

Stablecoin-backed RWAs and on-chain cash flows now drive lending protocols and DeFi yields, which is upgrading the entire DeFi sector from speculative yield farms into a genuine bridge to traditional finance.

8. DePAI and DePIN Embody the Future

Decentralized physical infrastructure (DePIN) and its AI-powered extension DePAI are bringing hardware to Web3. Solana-based DePIN networks like Helium (wireless connectivity), Hivemapper (crowdsourced mapping), and Render (decentralized compute) each target ambitious use cases and have shown that tokenized infra can generate real revenue.

While it’s still early days and there are serious challenges around the quality of data needed and capital intensity, chances are good that blockchain technology will underpin the machine economy by managing incentives and proving proof-of-physical-work.

Proof-of-Physical-Work (PoPW) is a riff on Bitcoin’s Proof-of-Work consensus mechanism and rewards individuals with crypto-incentives for performing real-world tasks that can be verified, for example, world mapping, data collection, or operating hardware. It bridges the digital and physical worlds by using distributed ledger technology to build out networks like Helium or Hivemapper.

DePAI takes this one step further, envisioning autonomous robots, drones, and vehicles coordinating via blockchain tokens. Following NVIDIA’s CEO highlighted “Physical AI” at CES 2025, projects like OpenMind are building open-source robot operating systems for embodied AI. On Solana, projects like BitRobot are using cryptocurrency to incentivize robot training.

DePAI’s stack includes:

- Humanoid robots (hardware)

- Agentic AI software

- Crowdsourced data

- Decentralized 3D world models

- DePIN networks for compute, energy, and storage

9. Agentic Finance Is Here

Artificial intelligence is meshing with crypto in transformative ways in 2026, even if they are polar opposites in many ways. Blockchain focuses on certainty and shared truth that anyone can verify, while AI focuses on prediction and learning from data, often acting like a black box that not everyone can fully see or control.

AI-powered agents are a top trend for 2026. We’ll see more autonomous AI applications managing portfolios, making real-time decisions, and optimizing networks.

The year started with an explosion in popularity of a new type of AI tool. OpenClaw (first called Clawdbot and then Moltbot) is the first fully autonomous mainstream AI personal assistant. It was acquired by OpenAI last week after a bidding war between Web2 giants, including Meta.

OpenClaw is open-source and designed to run locally on a user’s hardware. It seamlessly integrates messaging platforms like Telegram, WhatsApp, and Slack that can use your local files, browser, and shell commands to execute tasks through natural language. Some users are already applying it to crypto trading tasks. While it’s still very clunky with some serious security concerns, chances are that it will go mainstream soon after OpenAI bundles it with ChatGPT.

“Agentic Finance” describes autonomous AI agents becoming economic entities. On the Gnosis chain, AI-initiated transactions already account for over 39% of SAFE (smart account) transactions and 340,000 monthly prediction market transactions.

Industry research predicts that within a few years, DEX volume generated by AI agents will exceed human trading.

Supporting agent-to-agent micropayments requires low-latency networks like Solana and machine payment protocols. AI is also revolutionizing on-chain security, enabling real-time fraud detection and near-instant smart contract debugging. This could dramatically reduce Web3 security risks like wallet drainers, malicious approvals, and AI crypto scams.

10. Next-Gen Wallets and Neo-Banking

Crypto wallets are morphing into full-service neo-banks. As more capital and businesses operate on-chain, standalone Web3 wallets that only hold and send tokens are becoming inadequate. The next phase integrates custody, payments, yield, reporting, and compliance into unified interfaces.

On-chain neo-banks like Revolut gained significant traction in 2025.

Self-custodial wallets have become the killer crypto consumer app. Millions now use wallets like MetaMask and Phantom (read our safety guide here) daily.

Web2 fintech giants are incorporating blockchain features, focusing on stablecoin payments first before exploring full crypto integration. Elon Musk’s X is rolling out crypto payments and wallets, positioning itself to add stablecoin support.

It’s clear that Web3 wallets in 2026 will bridge DeFi and traditional finance as comprehensive financial service platforms—but Web3 users should remain vigilant about Web3 phishing, social engineering, and protecting their private keys.

Use a proactive crypto protection tool like Kerberus Sentinel3, a real-time Web3 security platform that can be installed as a browser extension in seconds.

11. ‘Spec Is Law’: Governance and Security

Security is still a major issue as even well-known DeFi projects were hacked in 2025. Developers now believe it is not enough to trust the code alone—protocols should follow strict safety rules that automatically block any risky or unsafe transactions before they happen.

This approach could prevent common exploits like reentrancy attacks, flash loan attacks, oracle manipulation, and liquidity pool drains. AI-assisted proof tools can help write specifications and serve as live guardrails, with analysts predicting deterministic, verifiable rules will enable near-real-time code scanning and debugging.

As crypto becomes infrastructure for finance and commerce, ensuring program correctness and resilience against smart contract vulnerabilities, front-end compromises, and cross-chain bridge vulnerabilities is essential.

As Kerberus founders Danor Cohen and Alex Katz have drilled into the Web3 sector’s heads last year (read our Kerberus 2025 recap here), the playbook is simple: in order for Web3 to thrive, security must be almost undetectable, and “just work.” Web3 systems must be built that make AI deception a waste of time and money for scammers.

12. On-Chain Bonds & Advanced Data Tools

Countries are piloting tokenized government bonds to simplify issuance, reduce costs, and expand retail access to sovereign debt. Hong Kong and Thailand have led experiments, while the European Investment Bank issued its first digital bond on Ethereum in 2021.

Source: LedgerInsights

Moving government bonds on-chain could make public finance faster, cheaper, and more inclusive. Meanwhile, advanced information aggregation tools are collecting data from governance, finance, and sensor networks, enabling businesses and governments to make real-time, data-rich decisions rather than relying on siloed analyses.

Conclusion

Across all these narratives, one theme stands out: utility over speculation.

Crypto in 2026 is going to be about creating decentralized infrastructure that delivers on its promise and works.

Payment rails, privacy layers, decentralized markets, AI agents, tokenized real-world assets, DeFi derivatives, stablecoins, ETF products, physical infrastructure networks, neo-bank wallets, improved security frameworks, and tokenized bonds are all bridging the gap between digital and traditional economies.

In summary, crypto’s best narratives build out new stories:

- Launchpads are maturing with fairness and compliance.

- Prediction markets offer new ways to capture sentiment.

- Privacy solutions are becoming indispensable.

- Perp DEXs provide deep liquidity.

- Stablecoins integrate crypto with mainstream finance.

- RWAs democratize access to assets.

- DePIN and DePAI bring blockchain to physical infrastructure.

- Neo-banks deliver seamless financial services.

- Governance frameworks are moving from code to specification.

- AI automates tasks and enhances security (but stay alert to threats like honeypots, fake airdrops, and impersonation attacks).

Together, these trends paint a picture of crypto evolving into a foundational layer of the global economy—promising more inclusive, efficient, and secure financial systems in the years ahead. The bear market will be tough, like it always is, but builders are laying foundations that will matter for decades to come.

FAQ

What are the biggest crypto trends in 2026?

The top narratives include stablecoins, real-world asset tokenization, AI agents, zero-knowledge privacy, perpetual DEXs, crypto ETFs, DePIN/DePAI, prediction markets, neo-banking wallets, fairer launchpads, and improved security governance.

Why is everyone talking about “utility” now?

A harsh market crash in early 2026 wiped out speculative bets. Investors shifted toward projects with real revenue, practical use cases, and connections to traditional finance rather than hype-driven tokens.

What are stablecoins?

Cryptocurrencies pegged to fiat currencies like the US dollar. They power DeFi payments and cross-border transactions. In 2026, dedicated stablecoin blockchains are launching and regulation is formalizing through the U.S. GENIUS Act.

What is real-world asset tokenization?

Representing physical assets (real estate, bonds, art) as blockchain tokens. This lets everyday investors buy and sell fractional shares of assets that were previously only accessible to the wealthy.

How is AI changing crypto?

AI agents are autonomously trading, managing portfolios, and improving security through real-time fraud detection. These agents are becoming independent economic participants, and their trading volume is expected to eventually surpass human activity.

What should I know about crypto security in 2026?

Watch out for phishing, fake airdrops, honeypot scams, and impersonation attacks. Always verify smart contract approvals, use reputable wallets, and protect your private keys. Security frameworks are improving, but personal vigilance is still essential.

Written by:

Werner Vermaak

Werner Vermaak is a Web3 author and crypto journalist with a strong interest in cybersecurity, DeFi, and emerging blockchain infrastructure. With more than eight years of industry experience creating over 1000 educational articles for leading Web3 teams, he produces clear, accurate, and actionable organic material for crypto users. His Kerberus articles help readers understand modern Web3 threats, real-world attack patterns, and practical safety practices in an accessible, research-backed way.

Read more about the authorRelated Guides

See more guides![Honeypot Crypto Scam: How to Detect & Avoid Them [2026 Guide]](/images/blog/Blog_Default_Banner.png)

Honeypot Crypto Scams: How to Detect and Avoid Them

Feb 18, 2026 • 4 minutes read

How to Use Phantom Wallet Safely: A Beginner’s Guide

Feb 12, 2026 • 4 minutes read

Wake Up! WEF 2026 Cybersecurity Report Sounds Alarm For Crypto Sector

Feb 11, 2026 • 4 minutes read

What is Self-Custody in Crypto? A Complete Beginner's Guide

Feb 9, 2026 • 4 minutes read

Install once & immediately get protected from scams, phishing and hacks. Zero losses for 250k+ users in 3 years. Now with up to $30,000 in coverage.