Wake Up! WEF 2026 Cybersecurity Report Sounds Alarm For Crypto Sector

The World Economic Forum's Global Cybersecurity Outlook 2026 puts crypto in the crosshairs. AI threats, fraud, supply chain risks—here's what actually works.

Key Takeaways

- The WEF's 2026 report surveyed 873 leaders and confirms crypto is a prime target, with 1 in 8 respondents personally affected by cryptocurrency fraud.

- AI is the top emerging threat, with 94% of experts flagging it as the biggest driver of change and deepfakes already impersonating crypto CEOs to scam users.

- Supply chain vulnerabilities are crypto's blind spot - only 33% of organizations fully map their ecosystem despite heavy reliance on centralized cloud infrastructure.

- Quantum computing is projected to break the public key cryptography that secures wallets and transactions by 2030.

- Proactive, real-time security tools are essential since post-mortem analysis alone can't stop AI-powered fraud in today's fast-moving threat landscape.

The World Economic Forum just dropped its Global Cybersecurity Outlook 2026, and if you’re in Web3 and crypto, you will need to pay attention, no matter your personal views on the controversial WEF.

The report surveyed 873 CEOs, cybersecurity experts, academics and CTOs, and indicates where the online threats are converging in 2026. As you may have suspected, the cryptocurrency sector is sitting right in their crosshairs, which is also confirmed by others such as Chainalysis’ 2026 Crypto Crime Report.

Here are a few of the biggest findings and insights from the report.

Before we continue:

Kerberus, the leading Web3 security tool, has cutting-edge products with a near 100% safety record over 3 years. They provide proactive online screening and real-time alerts to help their 250,000 users navigate crypto threats effortlessly, and back this up with up to $30k in coverage.

Simply install its Kerberus Sentinel3 browser extension for free, and get covered.

1. AI Poses Increasing Threat to Crypto Security

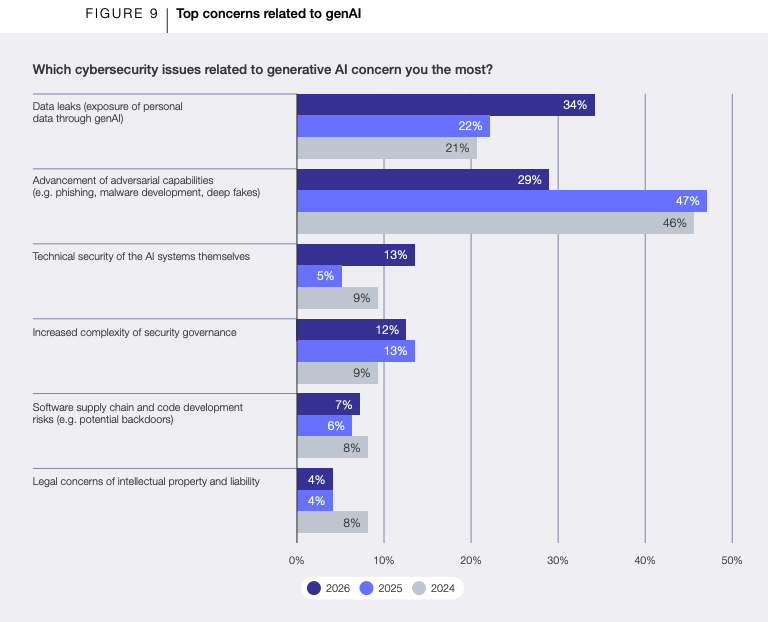

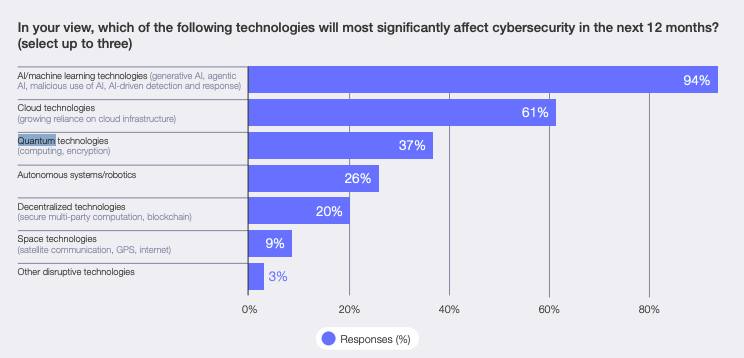

94% of cybersecurity professionals surveyed say AI will be the biggest driver of change in 2026. For crypto, that’s not just a statistic anymore, but already a reality.

AI-related vulnerabilities topped the list as the fastest-growing cyber risk in 2025, with 87% of respondents flagging it. Generative AI and agentic AI seem to be delivering exponential improvements each month.

Deepfake scams are impersonating crypto CEOs, AI-generated phishing campaigns fool even experienced traders, and automated tools are probing smart contracts for vulnerabilities faster than any human auditor could catch them.

Take the Indonesian President Prabowo deepfake scandal. Scammers used AI to create fake videos promising financial aid, swindling people across 20 provinces.

Source: TRMLabs

Now that same tech is targeting crypto users with fake announcements from Vitalik Buterin, CZ and other crypto figureheads.

About 77% of organizations now use AI for cybersecurity, particularly for detecting phishing (52%) and responding to intrusions (46%). Leading exchanges are deploying machine learning models that spot wallet drainer patterns and suspicious transaction flows before funds disappear.

But only 64% actually assess their AI tools for security before deployment. That’s up from 37% last year, but it still means more than a third of organizations are playing Russian roulette with AI-powered security tools.

When you’re protecting billions in digital assets, those odds are terrible.

2. Fraud Epidemic Hits Crypto Hardest

Nearly 3 in 4 (73%) of survey participants either experienced cyber-enabled fraud themselves or knew someone in their network who did.

Cryptocurrency fraud specifically hit 1 in 8 respondents, while phishing attacks affected 62%.

Remember that $1.5 billion Bybit crypto exchange hack linked to state-sponsored actors? Investigators estimated nearly 20% of the stolen funds vanished into unrecoverable assets almost immediately.

This is something confirmed by Kerberus CEO Alex Katz, who says that human error is clearly the weakest link in crypto security. Users get tricked into approving malicious transactions, connecting on fake interfaces, or revealing their private keys.

According to the WEF, the fraud toolkit targeting crypto users includes:

- payment and invoice fraud (37% affected)

- identity theft (32%), and

- romance and impersonation scams (17%).

Sadly, the brutal reality of cryptocurrency theft remains this, like we explained in our self-custody guide: once it’s gone, it’s gone for good.

Crypto’s pseudonymity and irreversible transactions make it the perfect getaway vehicle for fraudsters. You can’t chargeback a blockchain transaction. There’s simply no customer service line to call when your Bitcoin gets social-engineered into a scammer’s wallet.

3. Geopolitical Chaos Causes Regulatory Havoc

Two-thirds of companies surveyed reshuffled their cybersecurity strategies because of geopolitical volatility, with 2 in 3 firms specifically accounting for state-sponsored cyberattacks. For crypto companies operating globally, this fragmentation is creating a compliance maze to navigate.

Countries are starting to prioritize digital independence and data localization as a result. For crypto, this means navigating wildly different regulatory frameworks and AML/KYC compliance while somehow maintaining the borderless infrastructure that makes blockchain so valuable in the first place.

The divide is brutal: 91% of massive organizations have adapted to geopolitical risks, compared to just 41% of smaller players.

If you’re running a small DeFi protocol or a regional crypto exchange, you could be flying blind while nation states redraw the digital map around you.

Last year however has overall been a very good year for crypto regulation, as the Trump administration took proactive steps to bring favorable and clear US regulatory policy for digital assets.

4. Supply Chains Remain An Achilles Heel

Supply chain vulnerabilities are now the top worry for the most security-conscious organizations, with 65% flagging third-party risks as their biggest challenge. Just this month, dating apps Hinge and Match suffered a data breach that could expose their users to targeting by the crypto criminals responsible.

Think about Web3 and crypto’s infrastructure dependencies: cloud providers hosting nodes, third-party wallet libraries, blockchain explorers, custody solutions. A compromise anywhere in that chain cascades everywhere and can even, as we saw with data breaches in the past few years at big names like Ledger, OpenSea and Crypto.com.

We saw this repeatedly in 2025 when single vulnerabilities in widely-used libraries affected thousands of projects downstream.

According to the survey, very few organizations actually manage this risk:

- Only 66% assess their suppliers’ security

- Just 33% map out their full ecosystem

- 27% run cyber incident simulations with partners

For an industry that talks endlessly about decentralization, crypto relies heavily on centralized cloud infrastructure. The report shows 61% identify cloud technology as a major cybersecurity factor in 2026, and Web3 projects still run most “decentralized” applications on AWS, Google Cloud, or Azure.

5. Ransomware An Increasing Concern

While CEOs have shifted their anxiety toward fraud, many Chief Information Security Officers (CISOs) still rank ransomware as public enemy number one. They’re the ones who need to fix the operational chaos when systems go down.

According to a TRMLabs January 2026 crypto crime report, 2025 saw 93 new ransomware variants arrive, a near 100% increase from 2024.

Crypto platforms are juicy ransomware targets. They hold massive digital asset reserves, often in hot wallets to facilitate trading. Cyber criminals prefer crypto ransom payments anyway.

About 54% of respondents saw increased ransomware activity in 2025. For crypto exchanges, a ransomware hit represents a potential death spiral where suspended trading and frozen withdrawals trigger bank runs and irreparable reputational damage.

6. Skill Gaps Leave Web3 Security Vulnerable

85% of organizations with weak cyber defenses also lack the security talent to fix it. Compare that to highly resilient organizations where only 22% face skills shortages.

The geographic divide is worse.

- In Latin America and the Caribbean, 65% of organizations lack critical cybersecurity expertise.

- In sub-Saharan Africa, it’s 63%.

These are also regions where crypto adoption is exploding. We’re scaling cryptocurrency use in precisely the places least equipped to secure it. The roles in shortest supply such as threat intelligence analysts, DevSecOps engineers, identity and access management specialists are exactly what crypto platforms desperately need.

Without them, you can’t build secure smart contracts, detect sophisticated attacks, or properly manage wallet authentication systems.

7. Quantum Computing Is Going To Be a Problem (Soon)

About 37% of respondents think quantum computing will impact cybersecurity this year, but the WEF projects it becoming a real threat by 2030.

For crypto, that timeline should be TERRIFYING.

Most blockchain cryptography breaks under quantum attacks, especially the public key cryptography securing wallet signatures and transaction verification. NIST published post-quantum cryptography standards in 2024.

The problem? Legacy systems can’t easily migrate. Think about all those early Bitcoin addresses from 2010, 2012, 2015. Billions of dollars are sitting in wallets using outdated cryptographic schemes that will eventually be vulnerable to quantum attacks.

The WEF warns that organizations delaying quantum readiness will face serious systemic cyber risk. For crypto, that’s not a warning, but now a dangerous countdown.

What Cybersecurity Measures Actually Work?

The WEF research breaks down what separates the survivors from the victims. They identify seven critical factors:

- Leadership,

- governance,

- culture,

- processes,

- technical systems,

- crisis management,

- and ecosystem engagement.

The best-defended crypto organizations share these traits:

- Boards that actually engage with cybersecurity (99% vs 87% for weaker firms)

- Proper AI security vetting before deployment (83% vs 39%)

- Security baked into procurement decisions (76% vs 53%)

- Supplier security assessments (74% vs 48%)

30% of highly resilient organizations hold board members personally liable for cyber breaches, compared to just 9% of weaker organizations. It turns out when executives’ personal assets are on the line, security budgets mysteriously become adequate.

Final Thoughts

In summary, the WEF’s outlook paints a grim doomsday picture of converging threats such as AI-enhanced attacks, geopolitical fragmentation, supply chain vulnerabilities, and relentless fraud, that are all speeding up at the same time.

Cryptocurrency owners remain easy targets due to the technology’s borderless, private and immutable nature.

The threat landscape isn’t slowing down, and the big question is whether the crypto industry can get serious fast enough about security before the next billion-dollar wake-up call.

As Kerberus CTO Danor Cohen explained in Cointelegraph last year, we can’t rely on post-mortem analysis to stop threats like AI-powered crypto fraud in 2026. We need systems that provide proactive, real-time protection which ultimately make AI-driven deception “unprofitable and unviable.”

Those that embed security into their DNA, rather than bolting it on for compliance theater, will be the ones still standing when the dust settles.

Ready for real-time protection? Install Kerberus Sentinel3 and join 250k+ users with zero losses, 99.9% detection rate, and up to $30,000 coverage per transaction.

Written by:

Werner Vermaak

Werner Vermaak is a Web3 author and crypto journalist with a strong interest in cybersecurity, DeFi, and emerging blockchain infrastructure. With more than eight years of industry experience creating over 1000 educational articles for leading Web3 teams, he produces clear, accurate, and actionable organic material for crypto users. His Kerberus articles help readers understand modern Web3 threats, real-world attack patterns, and practical safety practices in an accessible, research-backed way.

Read more about the authorRelated Guides

See more guides

How to Use Phantom Wallet Safely: A Beginner’s Guide

Feb 12, 2026 • 4 minutes read

What is Self-Custody in Crypto? A Complete Beginner's Guide

Feb 9, 2026 • 4 minutes read

Pig Butchering Romance Scams: How to Protect Your Crypto

Feb 8, 2026 • 4 minutes read

The Psychology of Crypto Scams: How And Why They Still Work

Jan 16, 2026 • 4 minutes read

Install once & immediately get protected from scams, phishing and hacks. Zero losses for 250k+ users in 3 years. Now with up to $30,000 in coverage.