Pig Butchering Romance Scams: How to Protect Your Crypto

Pig butchering scams stole $75B+ and grew 40% YoY. Learn how romance scammers use crypto to steal funds and how to protect yourself in 2026.

Key Takeaways

- Pig butchering scams have stolen an estimated $75 billion+ globally and are growing 40% year-over-year, making them one of crypto's biggest threats.

- Scammers spend weeks or months building fake romantic trust before directing victims to fraudulent crypto trading platforms that display fabricated profits.

- Never accept investment advice from online-only contacts, and treat any platform that demands extra fees to unlock withdrawals as an immediate red flag.

Introduction

Ever had a hot match on a dating site where you went from making dinner plans with a new romantic interest to losing money in a shady crypto investment within a week or 2?

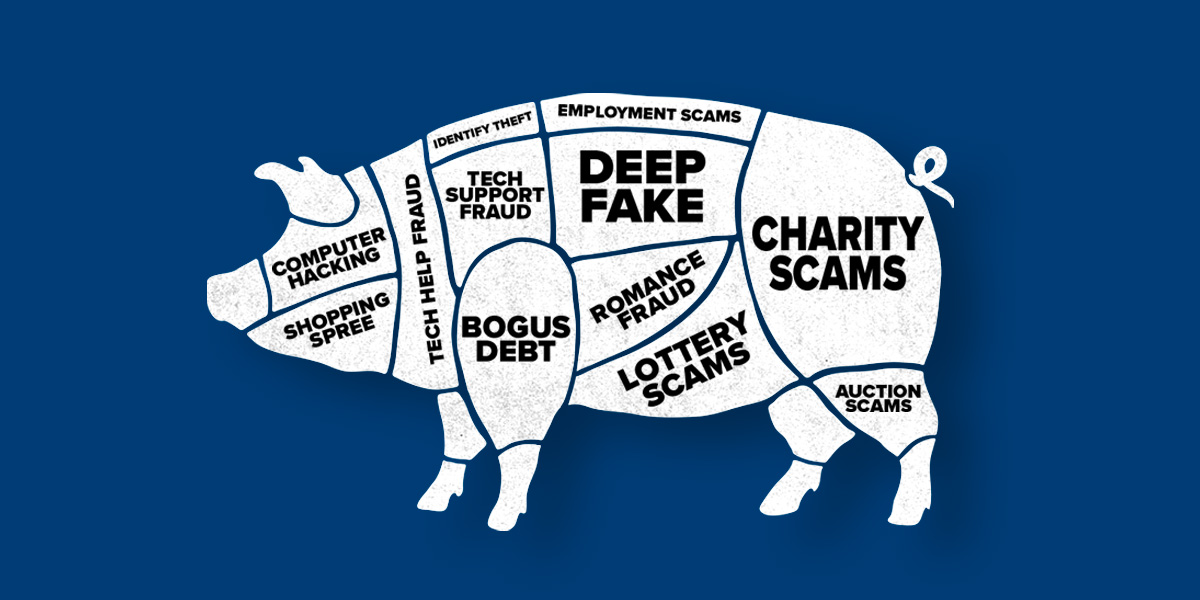

Oink Oink! You have most likely been the target of a pig butchering campaign, an unflattering but accurate term for an online romance or dating scam which often includes cryptocurrency elements.

The global online dating market continues to grow, with over 350 million active users in 2024 and a market valued at over $10 billion in 2023, growing at 7.4% through 2030. It’s driven by younger users (more than 50% are 18-29 year olds), which overlaps with crypto investor demographics.

While it sounds funny, pig butchering’s no joke, and comes with incredibly high stakes. This devastating form of online fraud combines emotional manipulation with fake investment advice, with the end game, leaving with a heist in cryptocurrencies and wrecked/REKT lives in its wake.

For most people, it gets annoying pretty quick and you’re able to spot the con from a mile away. However, these scams are astonishingly successful (even catching a bank CEO for $47 million) with a university study estimating up to $75 billion have been stolen over the years.

Yes, $75 BILLION! That’s more than the total market cap of Solana (now protected by Kerberus)!

A Chainalysis report in 2025 showed that pig butchering scams grew 40% year on year, with no signs of abating.

Source: Chainalysis

Source: Chainalysis

As we explained in our guide on the psychology of crypto scams, bad actors are not always going to try to hack your wallet or threaten you with physical violence. Why use force when you can simply trick your victim into handing you their assets willingly through so-called social engineering, such as address poisoning, or even better, through misguided lust/love?

The person you have the hots for online might not even be the same gender, culture or age bracket that you think they are, and could be carefully preparing to steal everything you have, with dragged-out psyops designed to drain your life savings.

Tragically, this person might likely be a trafficked human, as this Wired article showed, doing it against their will, often in poor Southeast Asian or African countries, where they essentially work as slaves to stay alive. On the flipside, China recently executed 11 ringleaders of a romance scam compound.

Here’s what you should know to avoid becoming a crypto romance scam victim in 2026.

What is a Pig Butchering Scam?

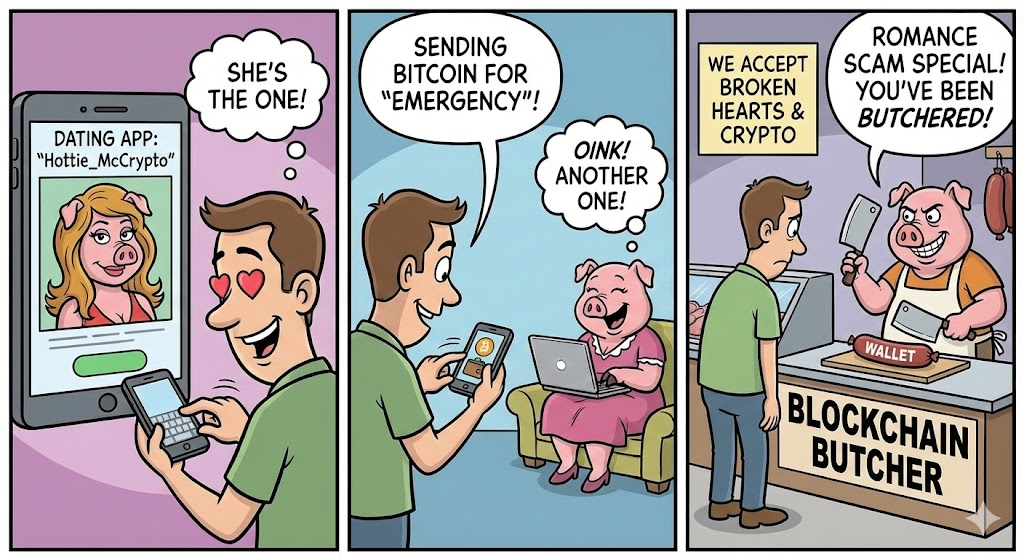

Pig butchering is not a wham-bam-thank-you-mam type of theft, but a long con where scammers build trust over weeks or months (“fattening the pig”) before persuading victims to deposit increasing amounts of money into fraudulent trading platforms. By the time victims realize the profits were fabricated, their savings are often gone.

Translated as Shāzhūpán in Chinese (literally meaning “kill pig plate”), a pig butchering scam is a Web3 security threat that uses romance to “fatten up” a victim with trust before “slaughtering” them for their life savings. And it works.

Why do victims fall for pig butchering romance scams?

Source: CNB

Source: CNB

These crypto-powered romance scams succeed because they exploit human psychology more than technology. Victims are not hacked in the traditional sense. Instead, they are persuaded, reassured, and emotionally groomed into making financial decisions that feel logical in the moment. By the time doubt sets in, the financial damage is already done.

What makes pig butchering especially dangerous is its scale and sophistication. These scams operate seamlessly across dating apps (e.g Tinder and Bumble), social media, messaging platforms like Telegram and X, and even professional networks like Linkedin.

Many victims believe they are learning real trading strategies from someone they trust, only to discover withdrawals are blocked once significant funds are committed.

How do romance scammers leverage crypto?

Pig butchering and crypto are linked because scammers use cryptocurrency as the rail, narrative, and cash‑out layer for these long‑con “romance-investment” frauds. This tactic relies heavily on social engineering techniques.

1. Fake “high‑return” crypto investments

Scammers groom victims emotionally, then pitch “exclusive” crypto trading or mining opportunities, promising high, low‑risk returns on bogus platforms that they fully control.

2. Real exchanges as on‑ramps

Victims are walked through opening accounts on legitimate exchanges or using crypto ATMs, converting fiat to crypto and then sending it to scam wallets or fake investment sites.

3. Fake dashboards using crypto prices

Victims see small early gains on professional-looking dashboards, which are completely fake. These scam sites mirror real market data and show fabricated balances and “profits” in BTC/ETH/USDT so victims believe they’re winning and keep “fattening” the account with more deposits.

4. Irreversible payments and near-impossible funds recovery

Once funds move on‑chain, transactions are irreversible and often pseudonymous, which makes it much harder for victims or banks to claw money back compared with traditional wires or cards.

5. Crypto‑native laundering at scale

Organized groups route stolen crypto through chains of wallets, mixers, high‑risk exchanges, and tokens like USDT to disguise flows, enabling billions in pig‑butchering proceeds to be cleaned globally.

To better understand how modern online scams work and how to protect yourself, explore our Web3 prevention resources at Kerberus Learn.

How a Pig Butchering Scam Works: Step by Step

While the exact strategy may differ from victim to victim, the underlying structure remains remarkably consistent.

These scams are not random acts of desperation but carefully designed to build trust, create financial confidence, and then take advantage of the victim at precisely the right moment. Recognizing this pattern early on can interrupt the process before losses can escalate.

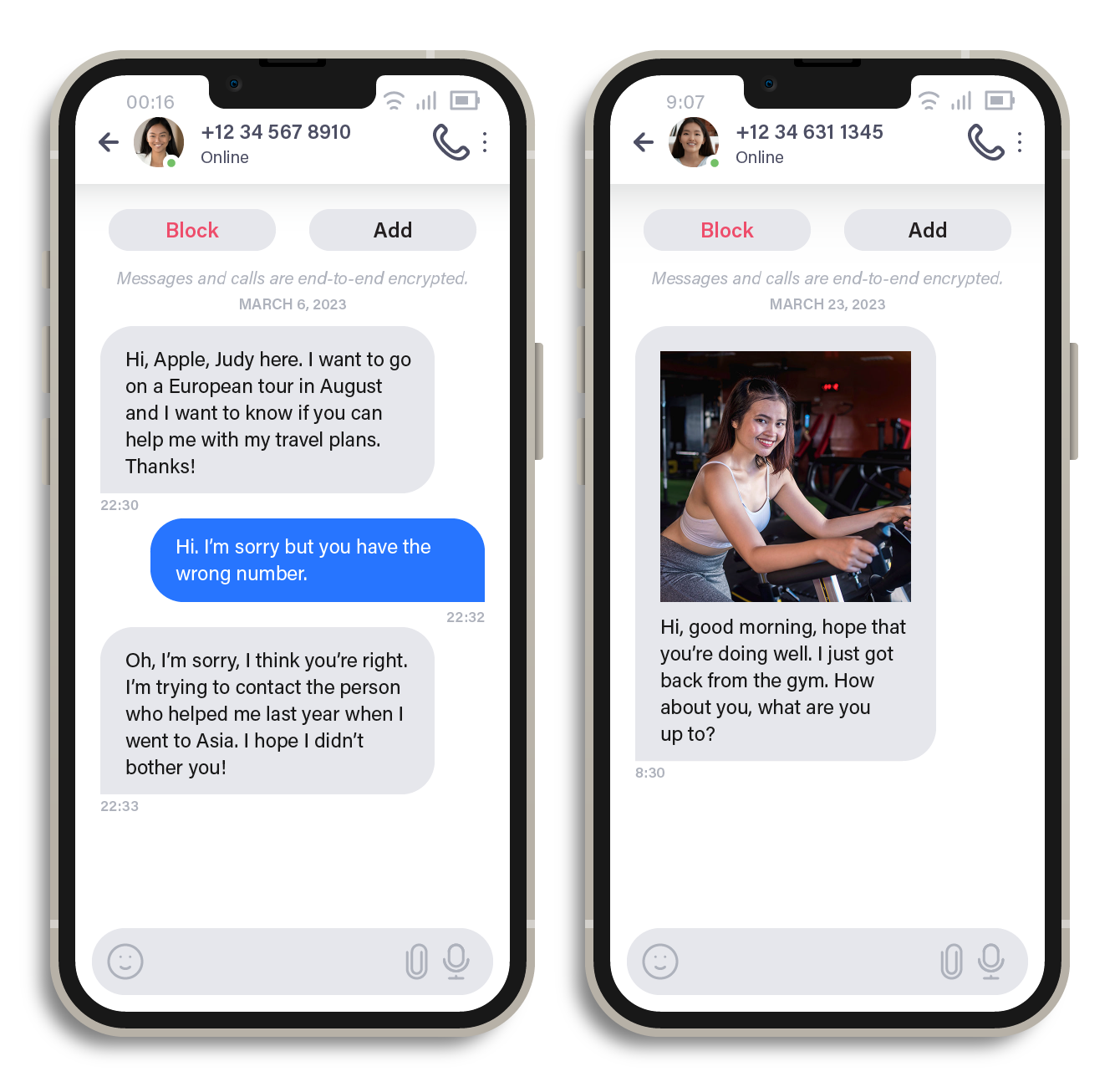

Stage 1. Initial Contact and Trust Building

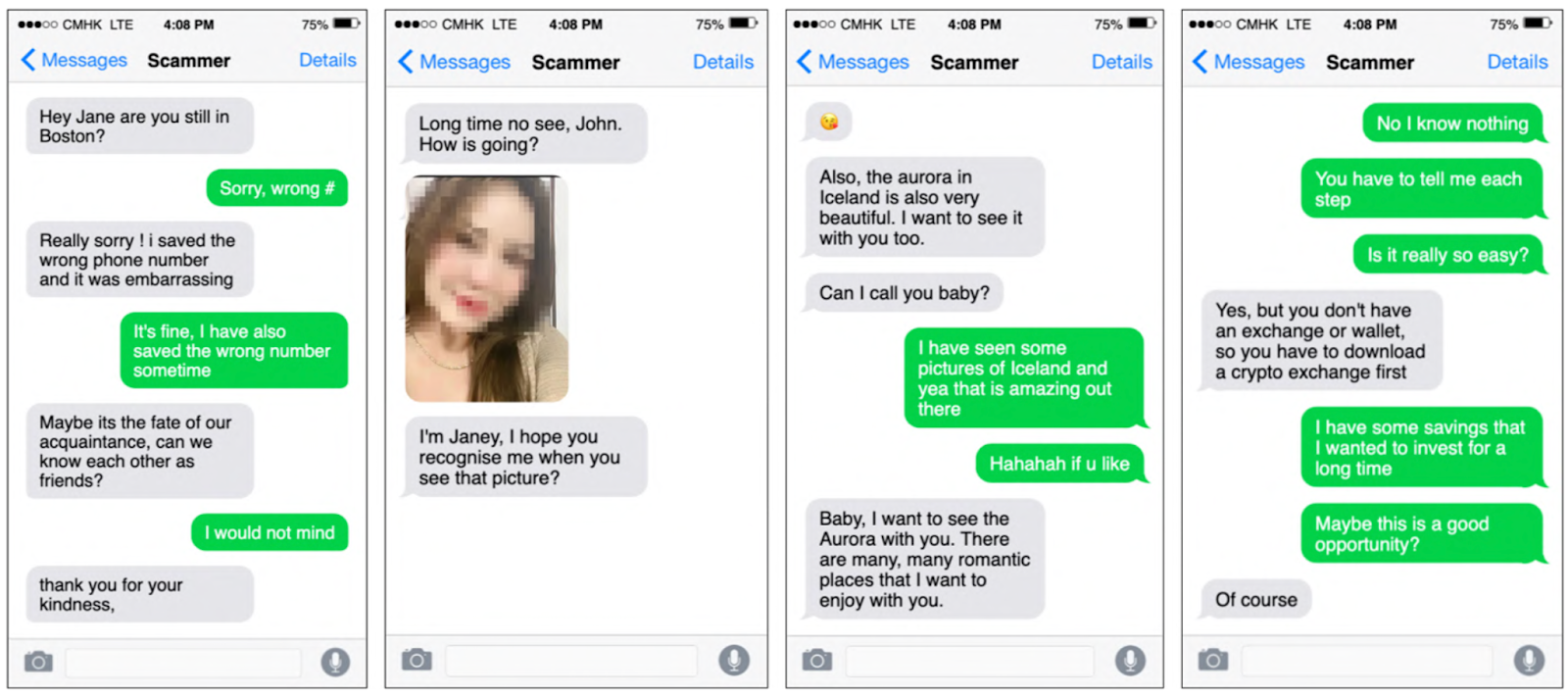

The love scam often begins with an unexpected match or message on a dating app, social media platform, or messaging service. The scammer presents themselves as romantic or friendly, successful, and financially knowledgeable. Over time, they build emotional or romantic rapport through frequent conversation and shared personal stories.

Source: TrendMicro

Source: TrendMicro

Attackers gradually trick you into revealing sensitive information rather than hacking your systems directly.

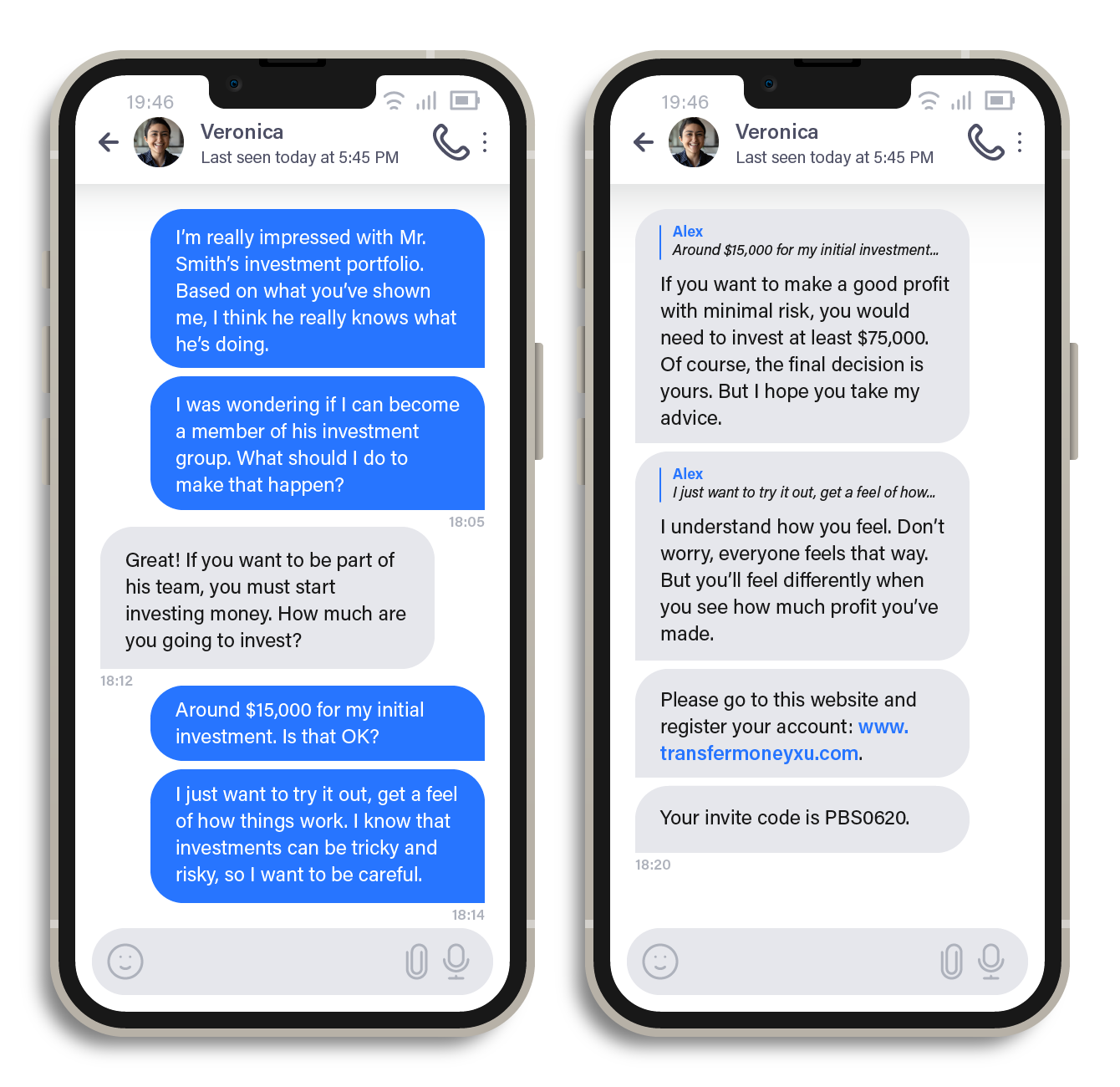

Stage 2. The Investment Opportunity

Once trust is established, the scammer introduces cryptocurrency trading as a safe way to generate income. Victims are shown screenshots of large profits and are told they can learn step by step.

They are directed to a fake crypto trading platform that looks professional but is fully controlled by the fraudsters. Educational material on how fraudulent platforms operate can be found at Kerberus Learn.

Stage 3. Small Deposits and Fake Profits

Source: TrendMicro

Source: TrendMicro

- Victims are encouraged to start with a small deposit.

- The platform displays fabricated gains to build confidence.

- In some cases, a small withdrawal is allowed to create the illusion of legitimacy.

This controlled success is designed to reduce skepticism and encourage larger investments.

Stage 4. Escalation and Financial Pressure

After larger sums are deposited, problems begin. Withdrawals fail, and victims are told they must pay taxes, verification fees, or security deposits to unlock funds. Each payment request is another layer of fraud, not a real claim.

Stage 5. Disappearance and Money Laundering

When the victim can no longer send funds, communication stops. Stolen assets are quickly moved across wallets and services designed to obscure transaction trails, including tools sometimes referred to as crypto mixers, which are defined in the Kerberus glossary.

Spotting a Dating Site Scam Early: Common Red Flags

Pig butchering scams succeed when they feel:

- personal,

- genuine,

- gradual, and

- financially convincing (hello FOMO).

Recognizing the warning signs early can prevent severe losses and emotional distress.

Here are the most obvious ones. However, there are many new angles appearing daily, especially as AI scams unlock new attack vectors for their creators.

Source: Elliptic

Red Flag 1: Online-only, and moving to Telegram or Whatsapp

A major warning sign is receiving investment advice from someone you have never met in person. Scammers often build fast emotional closeness while gradually introducing financial discussions. This manipulation technique is a form of social engineering, as explained in the Kerberus glossary.

A huge red flag is being asked to move conversations from dating apps or social media platforms like Tinder and Facebook to encrypted private messaging apps like Telegram or WhatsApp. Scammers feel they can reduce their risks and have tighter control over what they share and the overall narrative.

Once the conversations move to encrypted chatting apps, it becomes easier for fraudsters to send scripted messages, isolate victims from outside opinions, and, once the job is done, to delete the conversation history, removing all traces of the crime.

Red Flag 2: An unexpected “emergency” or “opportunity” arises

Suddenly, a crisis or money opportunity appears which your amour quickly shares with you. Victims are pressured to act quickly, especially when shown screenshots of large crypto profits. Requests to pay extra fees to unlock withdrawals are a critical danger sign, since legitimate investment platforms do not operate this way.

Remember Wolf of Wall Street?

https://www.youtube.com/watch?v=IBNlMerxKug

Red Flag 3: The investment platform has “technical issues”

Still not sure you’re about to get scammed? Take a closer look at the trading platform your new BFF has presented you with. Here are tell-tale signs:

- Fraudulent trading websites often lack verifiable company information, regulatory disclosures, or a real business address.

- Domains may have been registered recently. Customer support is limited to chat boxes with no verified phone or email channels.

- Account dashboards may show steady and unrealistic gains that do not reflect real market conditions.

How to Avoid Pig Butchering in 2026

It’s not difficult.

- Never accept financial advice from online contacts you do not know personally.

- Verify any platform through independent reviews and official regulatory listings.

- Use reputable exchanges, enable strong account security, and remain skeptical of guaranteed returns.

Or just use a proactive screening tool like Kerberus Sentinel3 to flag any suspicious activity early.

Already Sent Money? Do this next:

- Stop sending any more funds immediately.

- Save all chat records, wallet addresses, and transaction details.

- Report the incident to local cybercrime authorities

- Hope for the best.

Real-time Web3 protection tools like Kerberus Sentinel3 can help you greatly.

5 Massive Pig Butchering Cases

-

Prince Group / Chen Zhi: This alleged Cambodian conglomerate ran at least 10 forced‑labor scam compounds, stealing 12,271 BTC (≈ $15 billion) in crypto forfeiture actions, according to CNN.

-

Huione / Southeast Asia scam networks: Cambodia‑based Huione Group identified as a primary money‑laundering concern helping industrial‑scale pig butchering gangs move billions.

-

Funnull Technology Inc was identified by the US federal regulators as a Philippines‑based infrastructure provider for hundreds of thousands of scam sites, and linked to over $200 million in victim losses.

-

Heartland Tri‑State Bank failure: This Kansas bank’s CEO embezzled about $47 million, lost it to a pig‑butchering investment fraud as Coindesk reported, triggering the bank’s collapse.

Just another reason to self-custody your assets!

-

$112 million DOJ seizure: The U.S. Justice Department seized over $112 million in crypto from accounts tied to large‑scale pig butchering investment schemes.

How Kerberus Helps You Avoid Pig Butchering Romance Scams

Kerberus Sentinel3 can’t stop someone from emotionally grooming you, but its sophisticated real-time protection can block or help neutralize the on‑chain and Web3 steps where romance scammers actually steal funds.

Install its free browser extension here.

Here are 5 ways Kerberus, the gatekeeper of Web3, can help you keep your crypto.

1. Blocking or flagging scam sites before you reach them

Romance scammers often send victims to fake crypto investment sites or NFT platforms. These sites try to trick you into connecting your wallet and approving harmful transactions.

Kerberus automatically blocks these dangerous sites as you browse, so you never get to the point where your wallet could be drained—even if the link came from someone you thought you could trust.

2. Checking transactions before you approve them

When you’re about to connect your wallet or sign a transaction, Sentinel3 runs quick safety checks. It looks for warning signs like unlimited spending permissions, suspicious recipients, or unusual asset movements. So if a scammer tells you “just approve this to start investing together,” Kerberus can catch the danger and stop you before any money moves.

3. Protecting you from fake or swapped addresses

Many romance scams involve requests like “send crypto to this address.” Kerberus remembers the addresses you normally use and alerts you if something looks off—like a very similar fake address or one that’s been flagged as malicious. This helps catch the trick where scammers swap addresses to steal your funds.

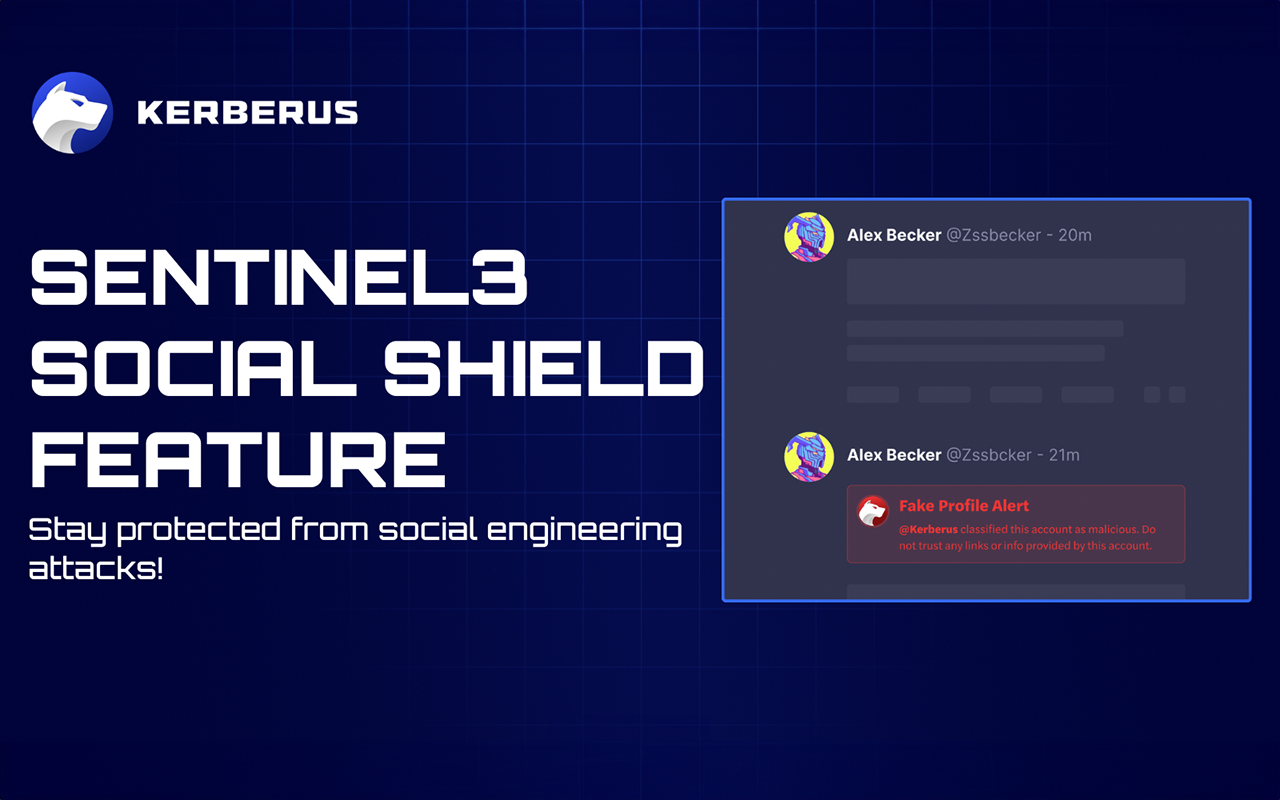

4. Protecting you across social media and the web

Romance scams usually start on dating apps or social media, then move to crypto. Scammers send malicious links through DMs, fake airdrops, or pretend to be customer support. Kerberus has a Social Shield function that watches for dangerous accounts and suspicious links as you browse, warning you before you click through to the scammer’s trap.

5. Coverage if something slips through

As a final safety net, Sentinel3 includes coverage of up to $30,000 for qualifying Web3 losses that slip past its protection. Kerberus’ security has been 99.9% flawless for its 250,000 users over the last 3 years.

Conclusion

Pig butchering scams represent one of the most psychologically devastating threats in Web3 today, combining emotional manipulation with sophisticated financial fraud.

The scale is staggering—$75 billion stolen and growing 40% annually—but protection is possible through awareness and the right tools.

Stay vigilant: never accept investment advice from online-only contacts, verify platforms independently, and trust your instincts when something feels rushed or too good to be true. Remember, real relationships don’t require immediate financial commitments, and real investment opportunities don’t pressure you with artificial urgency. Stay strong kings.

Protect your heart, your wallet, and your future by staying informed and using proactive security tools like Kerberus Sentinel3.

FAQ: Pig Butchering Scams

What is a pig butchering scam in simple terms?

It is a long-term online scam where someone builds trust with you, usually through friendship or romance, and then convinces you to invest in a fake crypto trading platform. Once you deposit a large amount, you cannot withdraw your money.

Why is it called pig butchering?

The name comes from the idea of fattening the victim over time. Scammers slowly build trust and encourage larger investments before taking everything at once.

Are pig butchering scams always related to crypto?

Most modern cases involve cryptocurrency because transactions are fast and harder to reverse. However, the core tactic is emotional manipulation and fake investments, which can appear in other financial forms too. You can learn more about common scam structures at Kerberus Learn.

How do I know if a crypto trading platform is fake?

Major warning signs include guaranteed profits, no verifiable company information, recently created websites, and pressure to deposit quickly. If withdrawals require extra fees, that is a serious red flag. Technical terms related to these tactics are explained in the Kerberus glossary.

Can victims recover money lost in a pig butchering scam?

Recovery is difficult but not always impossible. However, if you sent crypto, consider it gone, since it’s easy to cover your tracks through tools like crypto mixers. The most important step is to stop sending money immediately, save all communication and transaction records, and report the incident to authorities and professional investigators as quickly as possible.

Ready to protect yourself from pig butchering scams? Get Sentinel3 and join 250k+ users who have experienced zero losses with real-time transaction protection. Learn more about protecting yourself from wallet drainers and Web3 security threats.

Written by:

Werner Vermaak

Werner Vermaak is a Web3 author and crypto journalist with a strong interest in cybersecurity, DeFi, and emerging blockchain infrastructure. With more than eight years of industry experience creating over 1000 educational articles for leading Web3 teams, he produces clear, accurate, and actionable organic material for crypto users. His Kerberus articles help readers understand modern Web3 threats, real-world attack patterns, and practical safety practices in an accessible, research-backed way.

Read more about the authorRelated Guides

See more guides

How to Use Phantom Wallet Safely: A Beginner’s Guide

Feb 12, 2026 • 4 minutes read

Wake Up! WEF 2026 Cybersecurity Report Sounds Alarm For Crypto Sector

Feb 11, 2026 • 4 minutes read

What is Self-Custody in Crypto? A Complete Beginner's Guide

Feb 9, 2026 • 4 minutes read

The Psychology of Crypto Scams: How And Why They Still Work

Jan 16, 2026 • 4 minutes read

Install once & immediately get protected from scams, phishing and hacks. Zero losses for 250k+ users in 3 years. Now with up to $30,000 in coverage.